Internet shopping and our cities

Online shopping was on the rise long before Covid: in the UK, online sales rose from a monthly average of 3.3% of all retail activity to 19.1% between 2007 and 2019. But growth appeared to slow, and November 2019, the most active month of that year, showed no year-on-year increase. Then came the pandemic.

Suddenly, online sales shot up, peaking at 37.6% in January 2021. That percentage has since fallen, measuring 26.3% in October 2021, but this is still significantly ahead of where online sales would have been in the pre-pandemic growth trajectory.

What effect does this have on our cities and high streets? With online sales growth here to stay, we need the right real estate space and infrastructure to support that market.

Future of last mile

As we discussed in our previous article, “New business models for a different retail future,” we can expect to see more retail landlords incorporating logistics into their spaces. This theme arose in a roundtable discussion hosted by Make Architects, with participants discussing the significant opportunity for logistics, and micro-logistics in particular, to play a bigger role as online shopping grows.

There is a danger that without the effective management of deliveries, growth in online shopping will lead to more congestion and pollution in our cities. To mitigate this, 22 Bishopsgate in London has an off-site consolidation centre that collects packages for the building and delivers them twice a day. Developer AXA IM says this will reduce delivery emissions by 96%, making four-wheeled vehicles outside the building a rarity.

Others are going further by developing entirely new infrastructure for last-mile delivery. One example is Magway, a delivery company piloting a network of pipes to deliver packages on all-electric, zero-emissions pods. If realised, these pipes would stretch from warehouses to package destinations, removing a significant source of traffic on city streets.

Meanwhile, in Estonia a company called Starship Technologies recently launched a fleet of delivery robots, teaming up with an Estonian supermarket chain and a dark store to offer autonomous deliveries. The robots can carry items within a 4-mile radius, moving at a pedestrian speed, and customers can monitor the entire journey on their phone.

In the UK, Starship has partnered with Co-op to launch robotic deliveries in five towns and cities across the country. According to Co-op, shoppers will be able to choose from more than 3,000 items and receive deliveries in as little as 20 minutes.

Evolution of bricks and mortar

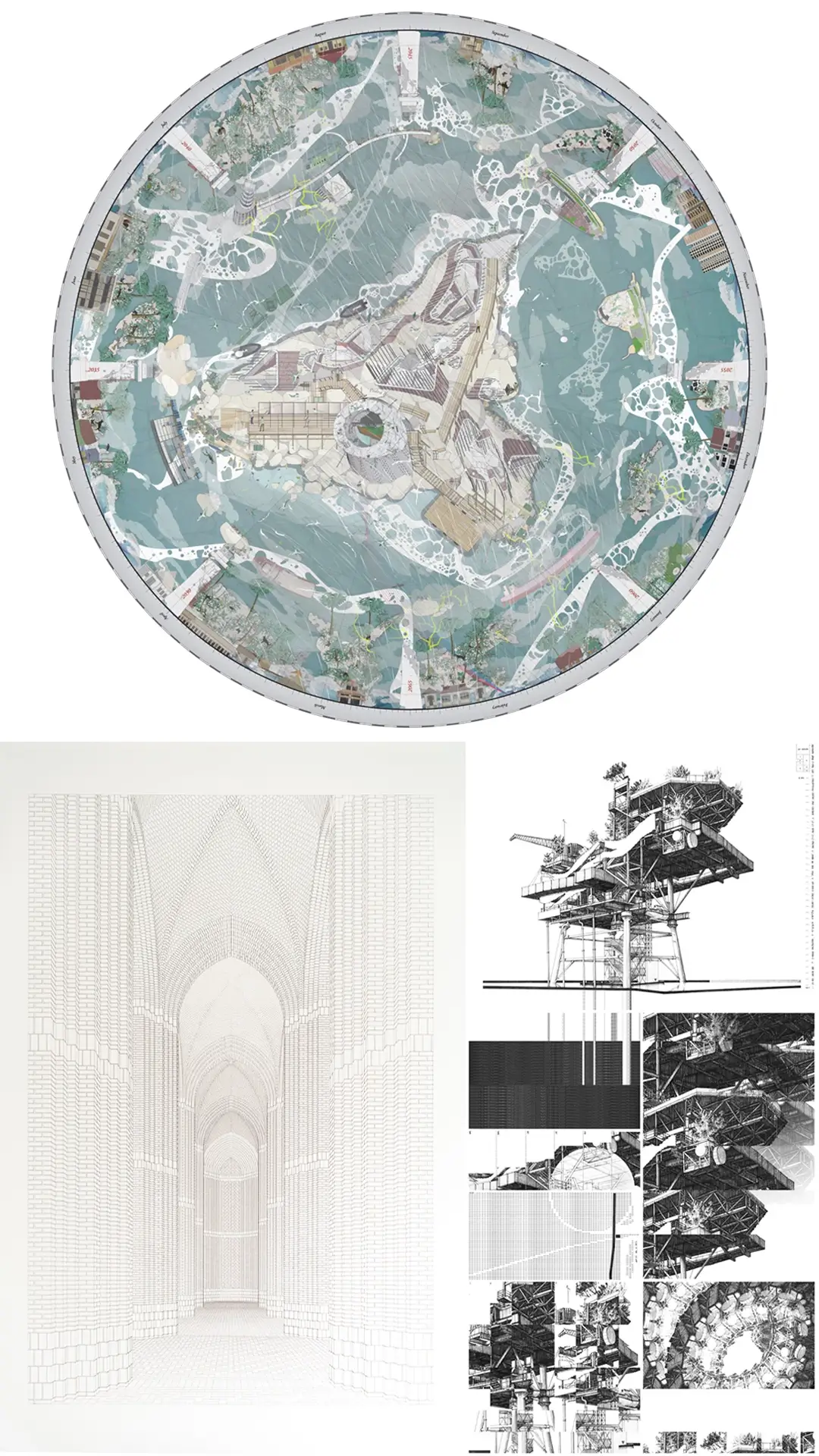

Online shopping will not replace physical stores, but it will shape what those physical stores will offer in the future. Asia-Pacific in particular was singled out as a “science lab for retail” during the roundtable discussion. With a young population and high levels of internet and social media adoption, the region is in an ideal place to experiment with and test out new trends.

One of these is the rise of experiential retail. If shoppers can get everything they want to buy from the internet, they need a different incentive to go to a real store. For example, a few years ago Nike started incorporating basketball courts, treadmills and shoe customisation bars in its stores in both Asia and other regions. One article described Nike’s New York store as “Legoland for people who love sports.”

Landlords themselves are also injecting other uses into their spaces. In October, Hong Kong’s former flagship Topshop store hosted Digital Art Fair Asia, the region’s first art fair focused on technology and contemporary art. Likewise, the nearby Central Market has been regenerated in recent years, introducing a number of different uses within the site, including events spaces.

Linked to experiential retail is another trend: placemaking through the addition of non-commercial features that add value for customers by either creating a nicer experience or connecting the store more directly with the wider area. Seoul’s Hyundai Mall is an example of creating an experience destination, with its 3,300m² park and a waterfall. The Crown Estate in the UK are a great example of making connections with surroundings, after spending lockdown widening footpaths and readying the streets for a socially distanced return – with the understanding that the environment directly outside ground floor retail is what will draw people in.

Ultimately, responding to online shopping is inevitable, but as these examples suggest, we are not facing the death of retail as we know it. We are facing a future of innovation and opportunity.

Our thanks to:

Albert Chu

Claire Hepher-Davies, The Crown Estate

David Waldren, Vicinity

Joanna Russell, Frasers

James Hepburn, Ipswich Council, Queensland, Australia

Lucy Puddle, Grosvenor

Paul Husband & Vicky Li, Husband Retail

Stuart Harris, Milligan

Make Retail Portfolio